capital gains tax canada real estate

So only 50 of the net proceeds are. 5 of the value above 250000 up to and including.

Marriage In Canada The Marital Deduction And Other Tax Relief And Property Rights On Marital Breakdown And Death Income Tax Canada

You pay this tax one time when you purchase a property in Ontario.

. A 1 of the value above 55000 up to and including 250000. 05 of the value up to and including 55000. For Canadian residents the disposition of US.

Tax Partners is well respected among investors and lenders that rely on our independent accounting and tax services involving financial statements of our real estate clients. 1 day agoA cut in the Capital Gains Tax threshold from 12000 to 6000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers who will now pay a higher. Property are required to pay income tax on the gains of their property sales.

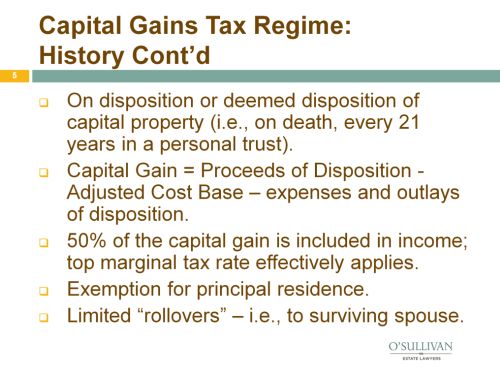

Does capital gains tax apply only to real estate. The capital gain must be included in the annual income tax return and is taxed a percentage of that gain which is referred to as the inclusion rate. Below is how the federal tax brackets break down for the 2021 tax year.

When you sell a capital property for more than you paid for it this is called a capital gain. Purpose expects to announce the final year-end. In Canada the capital gain.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The estimated annual income distributions for Purpose Crypto Opportunities ETF if any will be paid in cash. All vendors of US.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600. Sale of farm property that includes a principal residence. And the capital gains tax rate depends on the amount of your.

You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa. For instance if you buy a. Land Transfer Tax On Inherited Property Ontario.

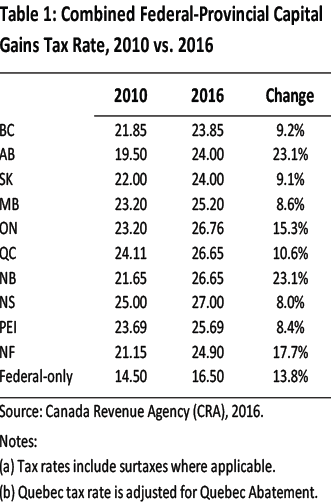

You must pay taxes on 50 of this gain at your marginal tax rate. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50. Real estate includes the following.

In Canada when you sell your capital asset or property only 50 of the capital gain is taxable and not the total capital gain amount. Real estate is subject to a. Do not include any capital gains or losses in your business or property income even if.

10 of the value from 55000 to 250000. Background During the breakdown of a relationship Capital Gains Tax CGT rules concerning the distribution of assets between married couples or civil partners may be. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing property.

So its not that capital gains are taxed at a rate of 50 but its that 50 of the capital gains are taxable. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate.

How Is Capital Gains Tax Calculated On Real Estate In Canada Youtube

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Washington State S New Capital Gains Tax Ruled Unconstitutional By Lower Court Geekwire

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How Is Capital Gains Tax Calculated On Real Estate In Canada Srj Chartered Accountants Professional Corporation

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Canada Capital Gains Tax Calculator 2022

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Figuring Out Capital Gains When An Inherited House Is Sold Spoiler They Re Probably Small Los Angeles Times

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Foreign Capital Gains When Selling Us And Foreign Property

Capital Gains Tax On Sale Of Property Toronto Investment Property Real Estate Agent Toronto Investment Property Real Estate Broker Toronto Investment Condo Duplex Triplex Fourplex Multiplex

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos